Streamline Salary Processing and

Compliance with Payroll

Automate salary processing, ensure tax compliance,

and empower your employees with Zoho Payroll

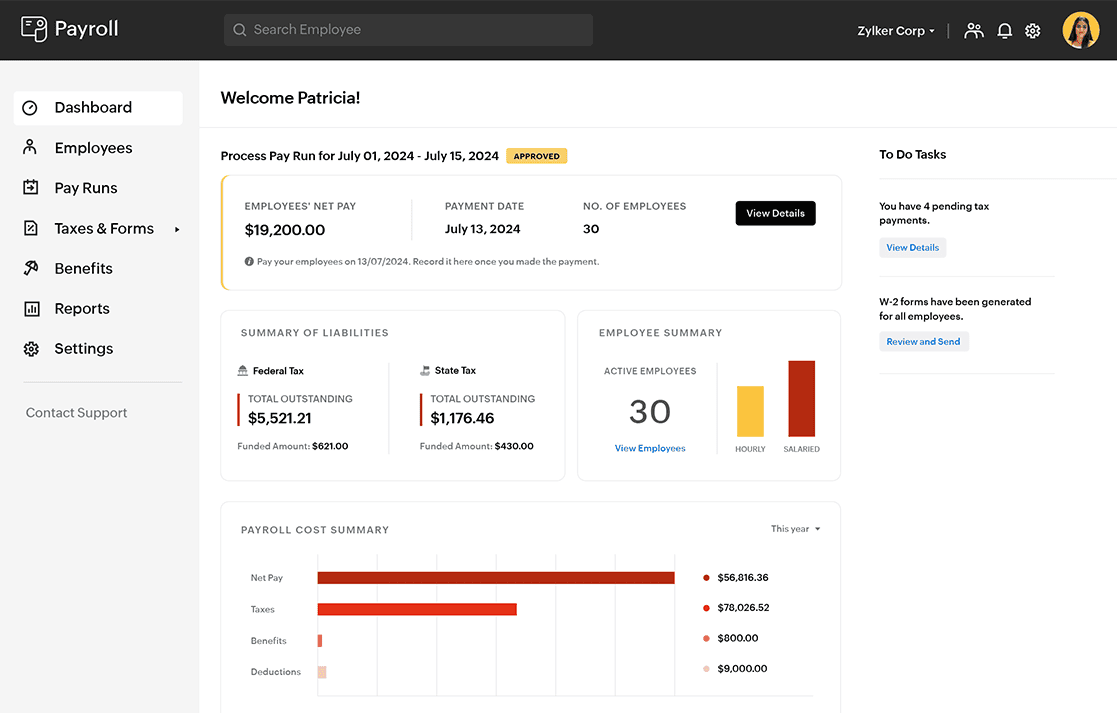

Track Payroll Metrics with Ease on the Dashboard

The Zoho Payroll Dashboard provides a comprehensive overview of your payroll processes, offering easy access to key metrics and reports. From here, HR teams can quickly view payroll status, pending tasks, tax calculations, and salary disbursements in real-time. The intuitive layout allows you to track employee payments, deductions, and compliance updates, making payroll management more efficient. It also enables users to generate detailed reports and gain insights into the payroll workflow, improving decision-making and ensuring transparency across the organization.

Smart Payroll Automation for Seamless Salary Disbursement

The Automated Salary Calculation feature in Zoho Payroll ensures accurate and error-free payroll processing. It automatically calculates employee salaries by factoring in earnings, deductions, bonuses, and taxes. With predefined rules and compliance settings, the system handles even complex salary structures effortlessly, saving time and reducing manual errors.

Zoho Payroll streamlines payroll processing with precision and efficiency. It automatically calculates employee salaries by incorporating components like basic pay, allowances, bonuses, and overtime. Deductions such as taxes, loans, and statutory contributions are seamlessly factored in, ensuring compliance with local regulations.

Automated Salary Calculation

Handles complex salary structures, including earnings, deductions, bonuses, and overtime, ensuring accurate and error-free payroll processing.

Direct Bank Transfers

Facilitates seamless salary disbursement via direct deposit to employees’ bank accounts, reducing manual intervention and processing time.

Tax Compliance Management

Automatically calculates and deducts taxes such as income tax, provident fund, and other statutory deductions, ensuring compliance with local regulations.

Employee Self-Service Portal

Allows employees to access payslips, tax statements, and payment records directly, enhancing transparency and reducing HR workload.

Integration with Attendance and Timesheets

Syncs with attendance tracking and timesheet systems to calculate salaries based on work hours, leaves, and overtime.

Accurate Tax Compliance Made Simple

The Tax Compliance and Statutory Reports feature in Zoho Payroll ensures your business adheres to local tax laws and regulations effortlessly. It automates the calculation of taxes like TDS, ESI, and PF, ensuring accuracy and timely compliance. The platform generates statutory reports such as Form 16, ECR, and PT reports, making it easy to file returns and stay audit-ready. With real-time updates on regulatory changes, Zoho Payroll helps businesses avoid penalties and maintain smooth operations while focusing on growth.

Automated Tax Calculations

Automatically calculates tax liabilities, including income tax, professional tax, and statutory deductions like Provident Fund (PF) and Employee State Insurance (ESI), ensuring precision and compliance.

Compliance with Local Regulations

Adapts to country-specific tax laws and regulations, providing up-to-date tax rates, deductions, and exemptions to meet statutory requirements.

TDS (Tax Deducted at Source) Management

Effortlessly calculates and deducts TDS for employees, generating detailed records for reporting and filing.

Simplified Tax Filing

Generates pre-filled tax forms, such as Form 16, Form 24Q, and other necessary filings, making tax submission easier and error-free.

Customizable Tax Policies

Supports company-specific tax structures, including exemptions, allowances, and benefits, to ensure personalized compliance for every organization.

Secure and Hassle-Free Direct Deposit Options

The Direct Deposit for Salary Payments feature in Zoho Payroll ensures seamless and timely salary disbursements directly into employees' bank accounts. By eliminating the need for physical checks, it streamlines the payment process, reduces administrative work, and minimizes errors. Employees receive their salaries on time, while HR teams save time and effort in processing payments. The integration with multiple banks ensures secure, hassle-free transactions, making payroll management more efficient and reliable.

Seamless Bank Integration

Integrates with multiple banks to enable direct salary transfers, ensuring quick and secure transactions without manual intervention.

Automated Payroll Processing

Processes and transfers salaries directly from payroll systems to employees’ bank accounts, eliminating delays and errors.

Multi-Bank Support

Supports deposits across various banking institutions, providing flexibility for companies with employees having different bank accounts.

Enhanced Security Measures

Implements advanced encryption and secure payment gateways to protect sensitive employee and financial data during transactions.

Timely Disbursements

Ensures salaries are deposited on time, reducing employee concerns and enhancing satisfaction.

Customizable Payment Schedules

Allows employers to set up flexible payment cycles (monthly, bi-weekly, etc.) based on organizational needs.

Transparent Payroll with Employee Self-Service

The Employee Self-Service Portal in Zoho Payroll empowers employees to manage their own payroll-related tasks, reducing the burden on HR teams. Employees can view and download their payslips, track leave balances, update personal details, and access tax-related documents anytime, anywhere. This self-service functionality enhances transparency, improves employee satisfaction, and ensures seamless communication between employees and HR while saving time on administrative tasks.

Access to Payroll Information

Employees can view detailed payroll information, including salary slips, tax deductions, and benefits, through an intuitive self-service portal.

Downloadable Payslips

Provides employees the ability to download their monthly payslips and year-end statements in just a few clicks.

Tax Declarations and Proof Submission

Allows employees to declare investments and upload tax-saving proofs directly, ensuring accurate tax deductions.

Leave and Attendance Integration

Employees can check leave balances and attendance records linked with payroll for better clarity on earnings and deductions.

Real-Time Updates

Reflects real-time updates on salary disbursements, reimbursements, and bonuses, improving transparency.

Simplify Financial and HR Operations with Zoho Integration

Zoho People Integration

Zoho Payroll integrates with Zoho People, enabling automatic syncing of employee attendance, leave data, and work hours into the payroll system. This integration ensures that payroll calculations are accurate, taking into account leave balances, overtime, and other work-related adjustments.

Zoho Books Integration

The integration with Zoho Books allows for smooth accounting by automatically syncing salary payments, tax calculations, and reimbursements. It enables easy financial reporting, tracking of payroll expenses, and simplifies tax filing, ensuring full compliance and visibility into business finances.

Seamless Data Synchronization

Automatically syncs employee information, attendance, and payroll data between Zoho People, Zoho Payroll, and Zoho Books, ensuring consistency and accuracy across platforms.

End-to-End Payroll Management

Combines attendance, leave, and tax data from Zoho People to streamline payroll processing in Zoho Payroll, reducing manual intervention and errors.

Integrated Expense Management

Connects Zoho Expense with Zoho Books and Zoho Payroll for efficient reimbursement tracking and accounting, ensuring smooth financial operations.

Unified Employee Self-Service Portal

Employees can access their HR records, payslips, tax documents, and leave balances from a single platform, enhancing user convenience.

Automated Compliance Tracking

Monitors statutory compliance requirements, such as tax filings and provident fund contributions, across integrated Zoho applications.

Real-Time Reporting and Dashboards

Provides centralized dashboards for HR and finance teams to monitor payroll, expenses, and employee data in real time, enabling data-driven decision-making.

Zoho Payroll offers different levels of support and features tailored to specific regions

1. India

Compliance Support

- Provident Fund (PF) management.

- Employees' State Insurance (ESI) calculations.

- Professional Tax (PT) compliance for different states.

- Income Tax (TDS) calculations and Form 16 generation.

Statutory Filings

- Direct integration with government portals for PF, ESI, and PT filings.

- Support for eTDS filings

Localized Features

- Gratuity and leave encashment calculations.

- Region-specific salary components like HRA and LTA.

Employee Benefits

Employee Benefits

- Integration with employee self-service portals.

- Loan and advance management.

2. USA

Compliance Support

- Federal, state, and local tax withholding calculations.

- W-2 and W-4 form management for employees.

- Direct support for Medicare, Social Security, and FUTA.

Payroll Processing

Payroll Processing

- Automatic calculation and disbursement of employee paychecks.

- Direct deposit support for employees.

Tax Filing

Tax Filing

- Automated tax filings for federal and state payroll taxes.

- Support for IRS forms like 941 and 940.

Employee Benefits

- Integration with health insurance and retirement plans.

- Time-off tracking and PTO accruals.

3. UAE

Compliance Support

Compliance Support

- Calculation of End-of-Service Benefits (gratuity) as per UAE labor laws.

- Management of region-specific allowances like housing and transport.

WPS Integration

- Support for the Wage Protection System (WPS) to ensure compliance with UAE regulations.

- Integration with UAE banks for salary disbursement.

Employee Benefits

- Management of allowances, bonuses, and other benefits.

Localization

- Arabic language support.

- Customization of payslips as per local requirements.